Commercial beverage display cabinets for supermarkets are experiencing steady global sales growth, with prices varying across brands and inconsistent equipment quality and cooling performance. For chain retail operators, selecting cost-effective refrigeration units remains a challenge. To address this issue, we conducted comparative analyses across four different importing countries, providing market cost references to help users make optimal choices.

1. First, the conclusion: when considering bare machines, China offers the best cost-performance ratio; when considering the total cost, some Southeast Asian countries are more cost-effective.

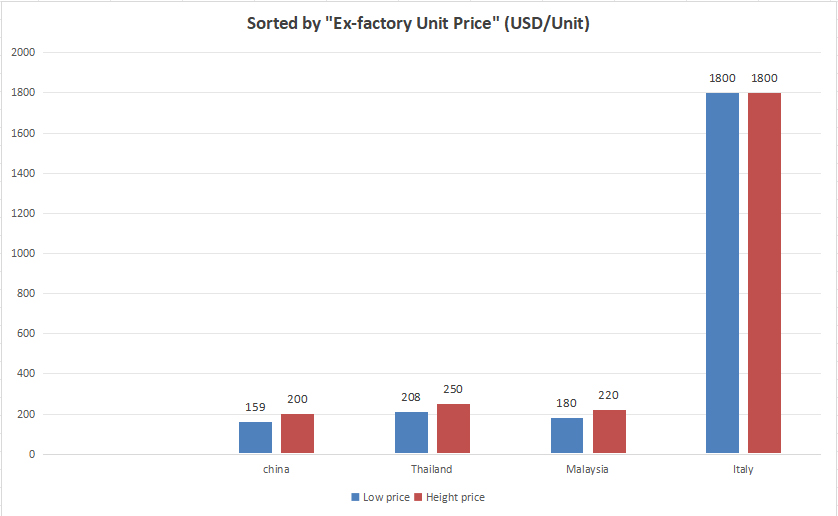

Many importers focus solely on the ‘unit price of equipment,’ but the actual landed cost equals the bare machine price plus tariffs, freight, customs clearance, and compliance fees. Significant differences exist in advantages across countries. Here’s a direct comparison table (latest data as of 2025):

|

Importing country |

Unit price of bare machine (commercial double-door model) |

core advantage |

Hidden costs / risks |

Suitable scenarios |

|

China |

$159-200 per unit (CIF price) |

1. The lowest unit price in the world with a mature supply chain; 2. A wide range of energy-efficient models with subsidies in some countries; 3. Customization support (such as LED light strips, multi-layer shelves) |

1. Higher tariffs apply to US and EU markets (approximately 12% for US beverage containers and 8% for EU); 2. Additional CE/FDA certification required (costs between 1,000 and 3,000 USD) |

1. The target country has no high tariffs on China; 2. Bulk purchase (≥10 units) with freight split |

|

Thailand |

$208-250 / unit (CIF price) |

1. Benefit from RCEP tariff reductions (including 0% ASEAN intra-market tariffs and 5% export tariffs to Australia); 2. Proximity to Southeast Asian/Australian markets with just 3-7 days shipping time |

1. Bare machine is 30% more expensive than China; 2. Fewer high-end models to choose from |

1. Focus on Southeast Asia/Australia; 2. Pursue rapid replenishment |

|

Malaysia |

$180-220 / unit (CIF price) |

1. Energy efficiency standards are suitable for the high-temperature environment in Southeast Asia (saving 20% of electricity); 2. Local certification is convenient (no additional energy efficiency testing required) |

1. Limited production capacity and long delivery cycle (45-60 days); 2. Few spare parts after-sales service outlets |

Small supermarkets in Malaysia and neighboring countries (Singapore, Indonesia) |

|

Italy |

€1,680 / TWD (about $1,800) |

1. Strong design sense (suitable for high-end supermarkets); 2. Local compliance with EU, no additional certification required |

1. The price is 9 times that of China; 2. The cost of transportation + tariffs is extremely high |

Luxury supermarket, high-end convenience store (pursuing brand tonality) |

2. Why is China’s bare machine the cheapest? But some people prefer to choose Southeast Asian imports?

1. China’s “low price logic”: supply chain + scale effect

China is the world’s largest producer of commercial refrigeration equipment, with brands such as Haier and KingsBottle accounting for more than 30% of the global market share. The cost advantage comes from two points:

- Upstream supply chain maturity: the localization rate of core components such as compressor and insulation layer is 90%, and the procurement cost is 25% lower than that in Thailand;

- Policy benefits: Energy-efficient beverage cabinets meeting the “dual carbon” standards qualify for 15%-20% export subsidies from the Chinese government, with these benefits directly reflected in the bare machine price.

2. Southeast Asia’s “Hidden Advantage”: Tariff + Timeliness

Take 10 beverage cabinets imported to Indonesia as an example to calculate the real cost:

- China import: bare machine 159×10=1590 + tariff 10%(159) + shipping (Shanghai-Jakarta 800) + customs clearance 200 = total 2749;

- Thailand import: Bare machine 208×10=2080 + RCEP tariff 0 (Indonesia is a member of ASEAN) + shipping (Bangkok-Jakarta 300) + customs clearance 150 = total $2530;

Result: Thailand imports are 8% cheaper than China, which is the magic of “tariff reduction + ocean transportation”.

3. Avoiding Pitfalls in Imports: 3 Cost-Saving Tips More Important Than ‘Country Selection’

1. First check the target country’s “tariff rules” before blindly choosing low prices

- Use HS codes (beverage cabinet HS code: 8418.61) to check tariffs: for example, when imported to Australia, China products are subject to a 5% tariff, while Thai products are exempted to 0 due to RCEP. In this case, choosing Thailand is more cost-effective.

- Avoiding “anti-dumping duties”: The US has imposed anti-dumping duties (up to 25%) on some refrigeration equipment from China. If targeting the US market, consider “China parts + Mexico assembly” (enjoying 0 tariffs under the US-Mexico-Canada Agreement).

- Bulk purchase (≥5 units): Choose sea freight for full containers (40-foot containers can hold 20 units, with shipping costs from Shanghai to Europe ranging from 2000-3000, averaging only 100-150 per unit after cost allocation).

- Small-batch replenishment: Choose LCL (Less than Container Load) shipping, with volume-based pricing (100-200 CNY/CBM), offering 80% cost savings compared to air freight.

- Note the surcharge: During peak season (June-August), shipping may incur an additional 10%-20% PSS (peak season surcharge). It is advisable to purchase during off-peak periods.

- EU market: must comply with Ecodesign regulations (energy efficiency A+ or above), China manufacturers need to spend an additional $2000 for certification, while Thai/Malaysian manufacturers come with local certification;

- For the U.S. market, products must meet both DOE energy efficiency standards and FDA food contact certification (2000-5000), with these costs factored into the total budget.

- Southeast Asian market: Some countries require ‘localization labels’ (e.g., Indonesia’s SNI certification). Suppliers should complete these in advance to avoid customs delays (container detention fees: 100-300 per day).

2. Choosing the right mode of transportation can save 30% of the cost

3. Do not ignore the “compliance cost”, otherwise the product may be returned

IV. Practical Suggestions: How to choose in different scenarios?

- Small supermarkets (purchase volume ≤5 units): prioritize China-made containerized shipping + transit near the destination country (e.g., China to Malaysia transit, enjoying RCEP tariffs), with total costs 15% lower than direct shipping;

- Chain supermarkets (purchase quantity ≥20 units): Directly contact China factories for customization (such as adding brand LOGOs, adjusting shelf height), with a 10% further discount on bulk prices, while locking in shipping rates for full containers;

- High-end supermarkets (pursuing quality): Choose “China core components + European assembly” (such as China compressor + German assembly), which avoids high tariffs and can also carry the “Made in Europe” label.

The ‘affordability’ of imported beverage cabinets is determined not by the bare machine price alone, but by the optimal combination of ‘bare machine + tariffs + transportation + compliance’.

- If the target country has no high tariffs on China: choose China (the king of cost performance);

- For markets dominated by RCEP members, prioritize Thailand and Malaysia for their tariff and delivery time advantages.

- For a high-end look, opt for European assembly (though the budget will double).

It’s advisable to spend 1-2 days researching the target country’s tariffs and certification requirements first. Then, contact at least three suppliers for a ‘full package quote’ (including bare machine, shipping, customs clearance, and certification). Compare the quotes before placing your order—after all, supermarkets operate on thin margins, and every penny counts.

Post time: Nov-07-2025 Views: